America’s Tax Refund Restlessness (2024)

“When will I get my tax refund?” Whether you’re self-employed, a small business owner, or an employee, it’s a question many of us type into our search engines each tax season. But some regions of the U.S. are keener than others to peer into the future of their IRS payday, prompting the question: Which cities in America are most restless for their tax refund, and why?

To find out, we took a two-pronged approach. First, we analyzed Google search volume related to tax refund status, including terms like “where’s my tax refund,” “IRS refund,” “IRS refund schedule,” and hundreds of other variations to create a ranking of where Americans are the most anxious to receive their tax refund.

Next, we conducted a nationwide survey of 1,500 Americans to determine how their tax refund impacts their overall financial outlook, how they plan to spend their refund, how much they expect to receive in refund dollars, and more, to get a better understanding of motivations behind the search trends.

Jump to

Key highlights

- Southern states dominate the map of restless refund researchers: over 4-in-10 residents of Mississippi (No. 1), Georgia (No. 2), and Alabama (No. 3) perform tax refund searches amid the season.

- States reporting higher poverty rates are strongly represented across our top 10 list of refund researchers.

- On the city level, Mobile, AL is the most refund eager. With 160,905 searches per 100,000 residents, many living in Mobile are conducting more than one search.

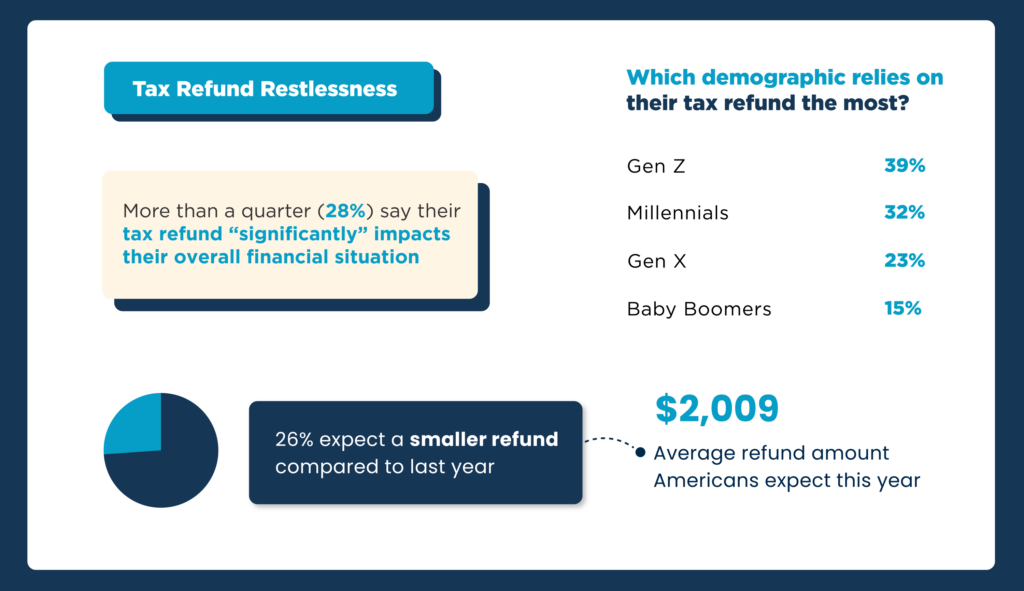

- More than 28% of survey respondents rated their tax refund as having a “significant” impact on their overall financial health.

- On average, Americans expect to receive a refund of $2,009 this year, and more than one-third (34%) of all respondents said they will put their refund money directly into savings.

Aside from Cleveland, OH (No. 2), every city on our top 10 list is situated in the broader southern region of the United States. From Mobile, AL (No. 1) to Baton Rouge, LA (No. 10), mid-sized southern cities (population ≤ 500,000) are most anxious for their tax refunds.

The top 9 refund-eager cities have a per capita search rate greater than 1, demonstrating that some residents are conducting more than one search related to refund timelines; this is most pronounced in Mobile, AL, where 160,905 searches were performed per 100,000 residents across the 2023 tax season.

Top five cities with the most tax refund restlessness

1

Mobile, Alabama

Emergent aerospace ventures and antebellum homes mingle in this city of 221,451. With the old crashing into the new, residents of Mobile have various life purposes but one central goal: get paid by Uncle Sam. Residents of the Azalea City perform refund-related queries 1.609 times per person across the tax season, which is 0.237 times more than the next most eager city.

2

Cleveland, Ohio

The disputed cradle of rock and roll (see: rock rival Memphis at spot #5), Cleveland might need its refund back to pay up for last night’s debauchery. Residents of the lakefront city are impatient for their IRS returns – 137,203.0 searches were conducted per 100,000 Clevelanders between the months of January and April, 2023.

3

Birmingham, Alabama

Historic Birmingham has seen its share of triumphs and tragedies, and today, its economically diverse population seems to know that the only way to face tomorrow is to take the bull by the horns. In 2023, residents of Birmingham conducted 130,917.3 refund-related searches per 100,000 residents.

4

Orlando, Florida

Home of Mickey, Minnie, and…Scrooge McDuck, Orlando attracts some residents who simply want to dive into a big pile of money. Folks living near the “happiest place on earth” seem to be asking, “How happy am I going to be, exactly?” as they conduct 1.296 tax refund searches per person throughout the season.

5

Memphis, Tennessee

Little-known fact: Elvis’ blue suede shoes were purchased with tax refund money. While that might not be verifiable, with the way Memphis residents research tax refunds, there’s a non-zero chance it’s true. Members of the other birthplace of rock and roll execute 127,582.3 per 100,000 residents to see how much “Viva Las Vegas” juice they have for summer.

States with the most tax refund restlessness

On the state level, our keyword search analysis supports the American South’s claim to being the nation’s refund restlessness capital, with 4-in-10 residents of Mississippi (No.1 most anxious), Georgia (No. 2), and Alabama (No. 3) conducting searches in the 2023 tax season.

States reporting higher poverty rates are strongly represented across our top 10 list of refund researchers, suggesting a rough correlation between a state population’s financial pressures and queries related to refund timing. Mississippi (19.7% poverty rate), Louisiana (18.6%), Arkansas (16.8%), and Alabama (16.2%) all search for refund-related terms much more than average.

Tax Refunds 2024

With inflation continuing to rise, interest rates remaining stubbornly high and the launch of a potentially contentious election year, Americans are feeling the crunch when it comes to personal finances in 2024, making refund money all the more valuable.

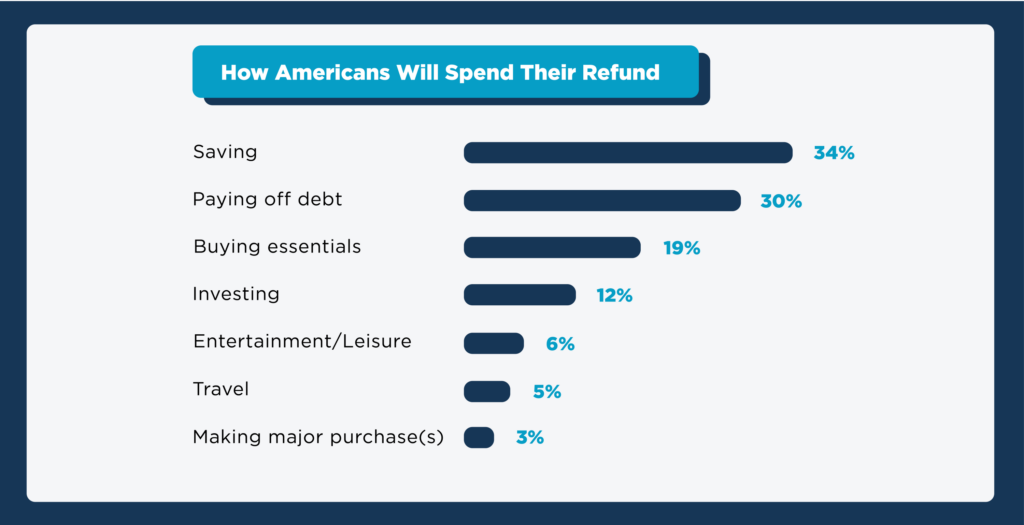

In our nationwide survey of taxpayers, we found that 28% say their tax refund “significantly” impacts their overall financial situation, one quarter anticipate spending their refund immediately after receipt, and 19% of all respondents said that their tax refund will be used to cover the cost of essentials.

For those with less urgent needs, a nearly even split of debt vigilance and future planning are reported, with 30% of respondents planning to spend their refund paying down debt, and 34% indicating that the money will be deposited into a savings account.

On average, Americans estimate they’ll receive their refund 8.5 weeks after filing their taxes. According to the IRS, refunds are typically issued in less than 21 calendar days, but the process can take four weeks or longer, especially for those who mail their tax returns.

Nearly one-quarter (24%) of Americans expect their tax refund to be smaller compared to what they received last year and only 18% expect their refund to be larger.

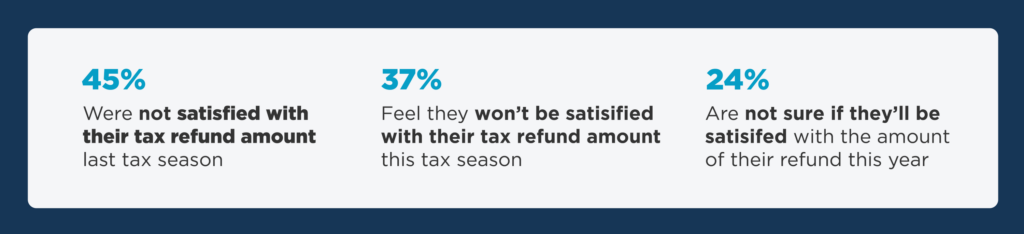

The majority of respondents (55%) labeled their 2023 tax refund “satisfactory”, but only 39% anticipate a “satisfactory” return this year, suggesting that last year’s returns might not satisfy this year’s growing needs.

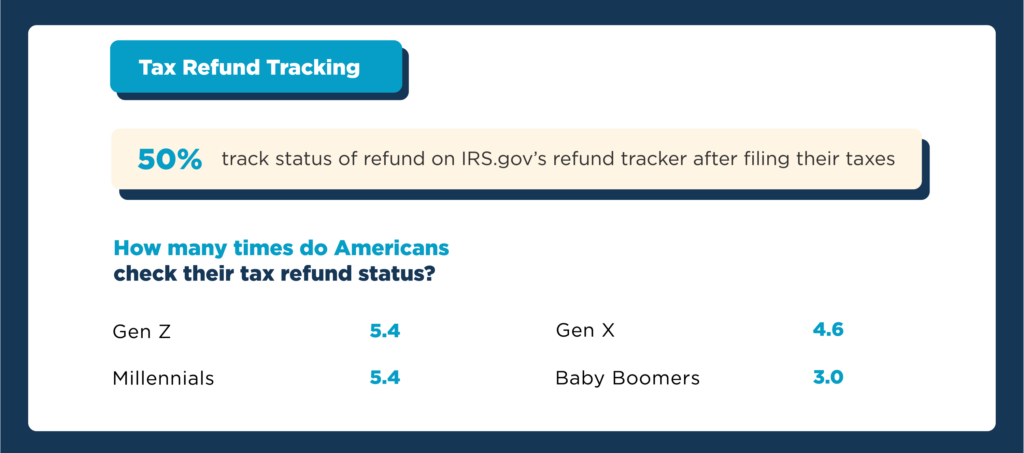

Drilling into refund research demographics reveals that Gen Z (5.4 times per season) and millennials (5.4) conduct refund-related searches more often than Gen X’ers (4.6) and boomers (3.0).

On average, Americans expect their refund to be about $2,009 this year. According to the Internal Revenue Service (IRS), the average refund in 2023 was $2,753, while the average in 2022 was $3,012.

Anxious to receive your tax refund this year? You can track the status of your refund 24 hours after you complete an e-filing or 4 weeks after mailing a return, according to the IRS refund tracking system. It’s important to remember that refunds can be delayed for several reasons. For example, if your tax return contains errors, is incomplete, requires further review, or is affected by identity theft, any of these issues can lead to a delay in receiving your refund.

As a small business owner or self-employed individual, you can leverage various tax advantages to reduce your tax rate. Depending on your business, you may qualify for deductions on home office, travel, automotive, advertising and retirement expenses.

But it’s a good idea to get started on the tax filing process as early as possible to ensure you maximize your deductions and receive any potential refund as early as you can.

Methodology

To determine our ranking, we analyzed each state, and more than 170 census-defined places with a population of 150,000 or more via the U.S. Census Bureau. We then analyzed Google search volume in each city and state for terms and keywords related to tax refund status such as “where’s my tax refund”, “tax refund status,” “IRS refund,” “IRS refund schedule,” and hundreds of other variations. Total search volume was then calculated per capita and ranked per 100,000 people in each city and state.

In January 2024, we surveyed 1,500 Americans to ask them about their experience with filing taxes and tax refunds. 55% of respondents were female, 42% were male and 3% were non-binary/non-conforming. The average age of respondents was 41.

Income: Under $20K (15%); $20,000-$39,999K (19%); $40,000-$59,999 (19%); $60,000-$79,999 (17%); $80,000-$99,999 (11%); $100K or over (19%).

Sources: U.S. Census Bureau, Internal Revenue Service, Pew Research Center, Google search volume analysis

Fair Use: Feel free to use this data and research with proper attribution linking to this study.

Media Inquiries: For media inquiries, contact [email protected]

Find out how to start an LLC in your state

Click on the state below to get started